India’s First Moody’s Upgrade in 14 Years Bets on Reforms

- IMPROVED CREDIT RATING. WHAT DOES IT MEAN?

- Inflation under control and there is more room for new money in the form of debt via new bond

issual - An improved credit rating, can enable lower benchmark interest rate.

- Lower interest rates will increase consumption.

- Increased consumption will result in more jobs created and consequently stronger growth rate.

- This domino effect will attract new and more investments, increased GDP.

- The Rupee will be strengthened and exports may become more expensive. GNP may not be better than GDP.

- On the other hand, a strengthened Rupee will lower the cost of Imports.

- If taxes are lowered further, it will boost the economy without affecting Government tax revenues. This must be a combo of both tax and interest reduction.

- Increased

economical infra-structure Government . - While stocks and stock markets will become bullish, stock markets are not a measure of the economy.

- The Indian Constitution is the result of a Coup d'Etat against Bose and is illegal making the persecution of Hindus legal by artificial intelligence led by genetically defective Mafia Karam Thapar-Journalists for mind-mental control of unsuspecting Indians.

- However, Moodys, Standard & Poor, Fitch, Al

Queda IMF and the Federal reserve are a part of the Anti-JFK-Bose Insider Oligarchy whose assets in India are mainly the Lutyens. Modi and his team are quite capable ofpllaying their own gamein their own turf and beating them for the sake of survival when the enemy within is very powerful.

India’s First Moody’s Upgrade in 14 Years Bets on Reforms

By , , and

Updated on

- Rupee and government bonds rally, stock markets surge

- Moody’s says reforms reduced risk of

sharp increase

Why Moody's Raised India's Credit Rating

Moody’s Investors Service raised India’s sovereign rating for the first time since 2004, overlooking a haze of short-term economic uncertainties to bet on the nation’s prospects from a raft of policy changes by Prime Minister Narendra Modi.

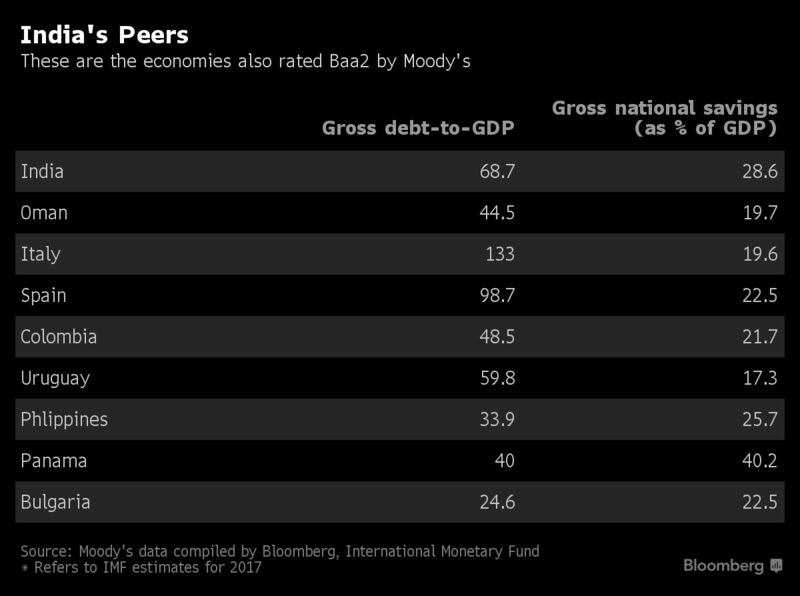

Rupee, bonds and stocks rallied after the ratings firm upgraded India to Baa2 from Baa3 and said reforms being pushed through by Modi’s government will help stabilize rising levels of debt. That’s a one-level shift from the lowest investment-grade ranking and puts India in line with the Philippines and Italy.

While government officials hailed the move as long overdue, some investors termed it a surprise given that India recently surrendered its status as the world’s fastest-growing major economy amid sweeping policy change. The upgrade could prove to be a big win for the ruling party, which is facing increasing attacks about the economic slowdown before key elections in Modi’s home state next month and a national vote early 2019.

The upgrade "reflects willingness for

The rupee surged as much as 1 percent and was trading up 0.6 percent at 64.92 per dollar as of 1:51 p.m. in

The upgrade will lower borrowing costs for India’s government and companies, according to Nischal Maheshwari, head of institutional equities at Mumbai-based brokerage Edelweiss Securities Ltd. While rating companies may have lost some of their allure globally following the 2008 financial crisis, their assessments are still seen as a stamp of credibility for emerging markets where national statistics can often be dodgy.

The upgrade "makes a big difference to investors," said Avinash Thakur, managing director of debt capital markets at Barclays Plc more public printing

Big Question

The question now is whether S&P Global Ratings and Fitch Ratings will follow, according to Nomura Holdings Inc., which expects the companies to wait for the government’s fiscal position before making any changes. The view is echoed by economist Gaurav Kapur at IndusInd Bank Ltd. -- who

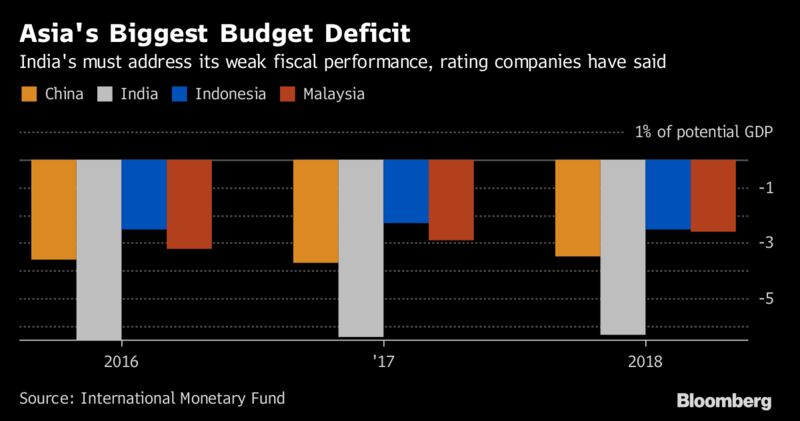

Fitch and S&P declined to comment on Moody’s action, and S&P reiterated Oct. 24 comments that "for an upgrade, India would have to address its weak fiscal balance sheet and weak fiscal performance." Both companies now rate India a notch below Moody’s.

Moody’s move "is an overdue correction,” said Modi’s Chief Economic Adviser Arvind Subramanian. "This is a recognition of India’s macro economic

Moody’s action was in line with the Bloomberg Economics model -- which predicted an upgrade based on the divergence between actual ratings and CDS implied credit ratings -- and could tip the balance toward a rate cut when the central bank decides on policy Dec. 6, according to Bloomberg economist Abhishek Gupta. The Reserve Bank of India didn’t immediately reply to an email and text message seeking comment.

Mixed Results

Modi has pushed through sweeping reforms, with mixed results. Moody’s acknowledged that the cash ban and goods and services tax have undermined growth in the near term. In the longer term, however, the GST will promote productivity by removing barriers to interstate trade, Moody’s said, also citing Modi’s improvements to the monetary policy framework, measures to clean up bad loans, and efforts to bring more areas into the formal economy.

"While India’s high debt burden remains a constraint on the country’s credit profile, Moody’s believes that the reforms put in place have reduced the risk of a sharp increase in debt, even in potential downside scenarios," according to the firm’s release.

The government has also won praise from ratings firms for a $32 billion program to recapitalize banks that economists say will revive lending and stoke demand on the ground. However, the "sovereign upgrade in itself will not lead to a blanket upgrade for ratings of the lenders in the country,” Srikanth Vadlamani, a Singapore-based vice president of the financial institutions group at Moody’s, said by phone.

Moody’s forecasts GDP growth of 6.7 percent for the fiscal year through March 2018, with a pick up to 7.5 percent in the following year and "similarly robust" levels from 2019 onward. That’s in line with the median 6.8 percent and 7.4 percent estimates

Populism’s Shadow

The upgrade adds to a string of good news for Modi. The World Bank said it’s getting easier to do business in India, with Asia’s third-largest economy jumping 30 places to rank 100th in the latest ranking released last month. Earlier this week, Pew Research Center said Modi remained a popular leader and public confidence in the economy and the overall direction had improved.

While these burnish Modi’s global credibility, questions have been raised at home about the health of the $2 trillion economy. Critics have questioned the wisdom of the cash ban

Moody’s is looking through the near-term political cycle ahead of state polls when "populism may overshadow reform momentum," according to Vishnu Varathan, Singapore-based head of economics and strategy at Mizuho Bank Ltd. The afterglow from the upgrade won’t last long given the emerging signs of quickening inflation and a widening current account and fiscal deficit, Varathan said.

— With assistance by Subhadip Sircar, Manish Modi, Shikhar Balwani, Arijit Ghosh, Nupur Acharya, Divya Patil, Anto Antony, Archana Chaudhary, and Ruth Pollard

No comments:

Post a Comment